So, you’ve received a postcard in the mail that says there’s an “important matter” concerning your mortgage that requires your immediate response. If you’re wondering if this is legit, you’re not alone. These strange postcards have been showing up all over - even prompting news stations to run stories warning about them. So what are they?

One thing’s for certain, the one you received did not come from Southern Bank - even if it mentions us. In fact, these didn’t come from any of the financial institutions they mention across the country. They seem to come from an unrelated 3rd party using public information from mortgage filings.

If you call the number on the card - which we don’t recommend - you’ll most likely end up talking to a machine, rather than a person, and it will ask you to provide personal information. We will never require you to provide personal information, like a full social security number, when we reach out. You should never provide your personal information over the phone, unless you are 100% certain of who you are speaking with.

Red Flags

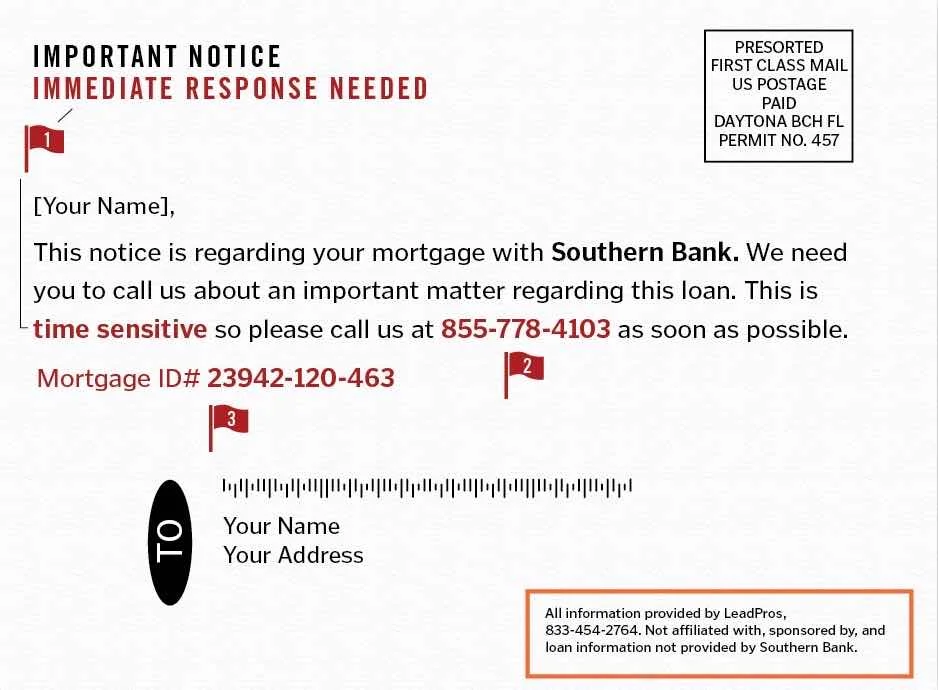

Most scams use the same tactics to draw information out of you. Knowing what to look for and what to do is the best way to protect yourself. Let’s take a look at the postcard that’s been going out, and we’ll highlight the red flags:

Let’s go over the Red Flags we marked above:

- IMMEDIATE RESPONSE NEEDED - Scams will always create a sense of urgency so that you will act quickly out of fear. It makes it easier for them to get information out of you before you figure out that something is wrong.

- Call us at 855-778-4103 - If the phone number listed is different from the number for your bank or financial institution, then this is another clear sign that something is wrong. You can always find our number on our website or official documents that you know came from us. If the number on the letter doesn’t match, then don’t call it.

- Mortgage ID # - We will always send notices containing personal information inside a sealed envelope. The fact that this information is on a postcard for anyone to see makes it suspicious. Other reports also mention that this mortgage id number is often a bogus number. If the mortgage id number is bogus, so is the letter.

The Big Reveal in the Small Print

You may have to squint to read it, but the tiny print on the bottom right is very revealing - we put an orange box around it for reference. It shows where this information is really coming from and admits that it is not in any way affiliated with Southern Bank. This is a prime example of why you should always read the fine print on anything you receive and look into any businesses mentioned.

This postcard points to a company called LeadPros. Others have been reported to mention businesses such as H.W.C., Mortgage Protection Services, loandepot.com, and more. A simple search into these companies shows that they are NOT legitimate, with terrible ratings on the Better Business Bureau and reports of scams all over. These business names are just a cover for scammers who have accessed publicly available information in order to target the people that hold them.

If you get an email, phone call, or letter that has these red flags, DO NOT give them any information. Instead, reach out to us at the number listed on our website. We already have your information on file, and we’ll be able to tell if it came from us. We can also use the information to warn the rest of our customers, so even if you’re sure it’s a scam, we still appreciate hearing about it.

For more tips on avoiding fraud you can check out 9 Tips to Avoiding Fraud.