If you’re like most people looking at homes these days, you’ve probably downloaded one of the apps - if not all of them - that help you watch the market and see what’s out there. You may also see advertisements showing you what you could pay and how you can get prequalified. This may have you wondering what being prequalified even means and how it happens. We’ll walk you through what prequalification looks like and what information you need to get started.

Something you need to remember throughout the process is that you want to find what’s comfortable for your budget. While you could get a mortgage for the highest amount possible, it’s best to stick to what’s most doable for you. A good rule of thumb is to get a mortgage that is no more than 28% of your monthly gross income, including taxes, fees, and insurance. A great home could become your dream home if you can truly afford it, and a dream home could become a nightmare if you can’t.

What does prequalifying mean?

Prequalifying for a mortgage means a lender has agreed on an amount that you could be approved to borrow for a home loan. It is NOT a guaranteed approval - it simply means a lender has looked at the information you provided to them, and has decided that you could be approved down the road.

When should I get prequalified for a home loan?

It’s best to get prequalified before you start looking at houses. A prequalification will give you an idea of how much you may qualify to borrow and what price range to look in.

How to get prequalified for a mortgage

The process of getting prequalified is relatively simple. To get prequalified, your mortgage lender will typically ask for income information, some personal information to run a credit check, how much you’ll put down, and how much you’re looking to borrow. What information you’re asked to provide may differ by institution.

The lender will take all this information and give you a prequalification letter if everything looks good. According to

Nerdwallet,

you can get prequalified within a day or two.

The best way to ensure your prequalification is to understand what the bank or mortgage lender will consider and make sure you have everything in order.

Here’s what your lender will look at:

-

Credit History and Credit Score

Lenders will look at your history of making on time payments, the types of credit you have, and the overall length of your credit history. If you’ve made late payments or don’t have a very long credit history, it could reflect unfavorably.

Your credit score will also have a big impact on your ability to qualify. Most lenders require a score of 620 or higher for conventional loans, and while FHA loans are usually different, some require the same score for those as well. To get the best interest rates available, you’d need to have a score of 760 or above.

Credit utilization - the amount of available credit you have used (as a percentage of the credit available to you - is also important. Your credit utilization needs to be under 30% to increase your chances of getting prequalified.

Be sure to check your credit score often when you go to buy a home to ensure that your score and credit utilization stay where you need them to be.

Read More: How to check and improve your credit score > -

Debt to Income Ratio (DTI)

Your Debt to Income Ratio (DTI) refers to how much of your gross monthly income is eaten up by debt (expressed as a percentage). In other words, your lender wants to know how much is left after all the bills are paid.. A high DTI may lower your chances of getting a mortgage; Most lenders look for it to be under 43% 1 . -

Employment and Income

Mortgage lenders will always want to make sure that you are employed with a stable income before approving you for anything. The amount of time you’ve been at your current job will have an impact, as well as how much you make. Stable employment of 2+ years with a steady income gives your lender confidence that you can handle taking on more monthly debts. -

Loan to value ratio (LTV)

The loan to value ratio is the mortgage amount divided by the appraised value of the home. From your lender’s perspective, a lower LTV means a less risk for the lender, making approval more likely down the road.

Note: The best way to lower your LTV is to make a larger down payment. You could also try to negotiate a lower price if possible.

Understanding all of these factors can really clear things up and give you an idea of what to expect when seeking a prequalification. Additionally, here are a few tips to help you throughout the process:

- Understand the process - We have a great home buyer checklist that can guide you not only through prequalification, but the entire process from finding an agent to closing.

- Find what’s comfortable for your budget - While you could get a mortgage for the highest amount possible, it’s best to stick to what’s most doable for you. A good rule of thumb is to get a mortgage that is no more than 28% of your monthly gross income, including taxes, fees, and insurance. A great home could become your dream home if you can truly afford it, and a dream home could become a nightmare if you can’t.

- Save up - Lenders may consider the amount of money you have saved up during approval. It can also help increase your down payment, making approval more likely.

- Try a local bank - A lender at a local bank could end up being more accessible making it easier to get answers to some of the questions or concerns you have. This could bring some reassurance throughout the process that you are getting what you need in a mortgage.

- Use an online calculator that takes your information into account - Some apps will estimate your payment for you based on current mortgage rates, but they may not be accurate to your situation. It’s best to use an online calculator that allows you to enter information accurate to you. To help you get an idea of the mortgage loan payment you could be making, you can use our monthly payment calculator here.

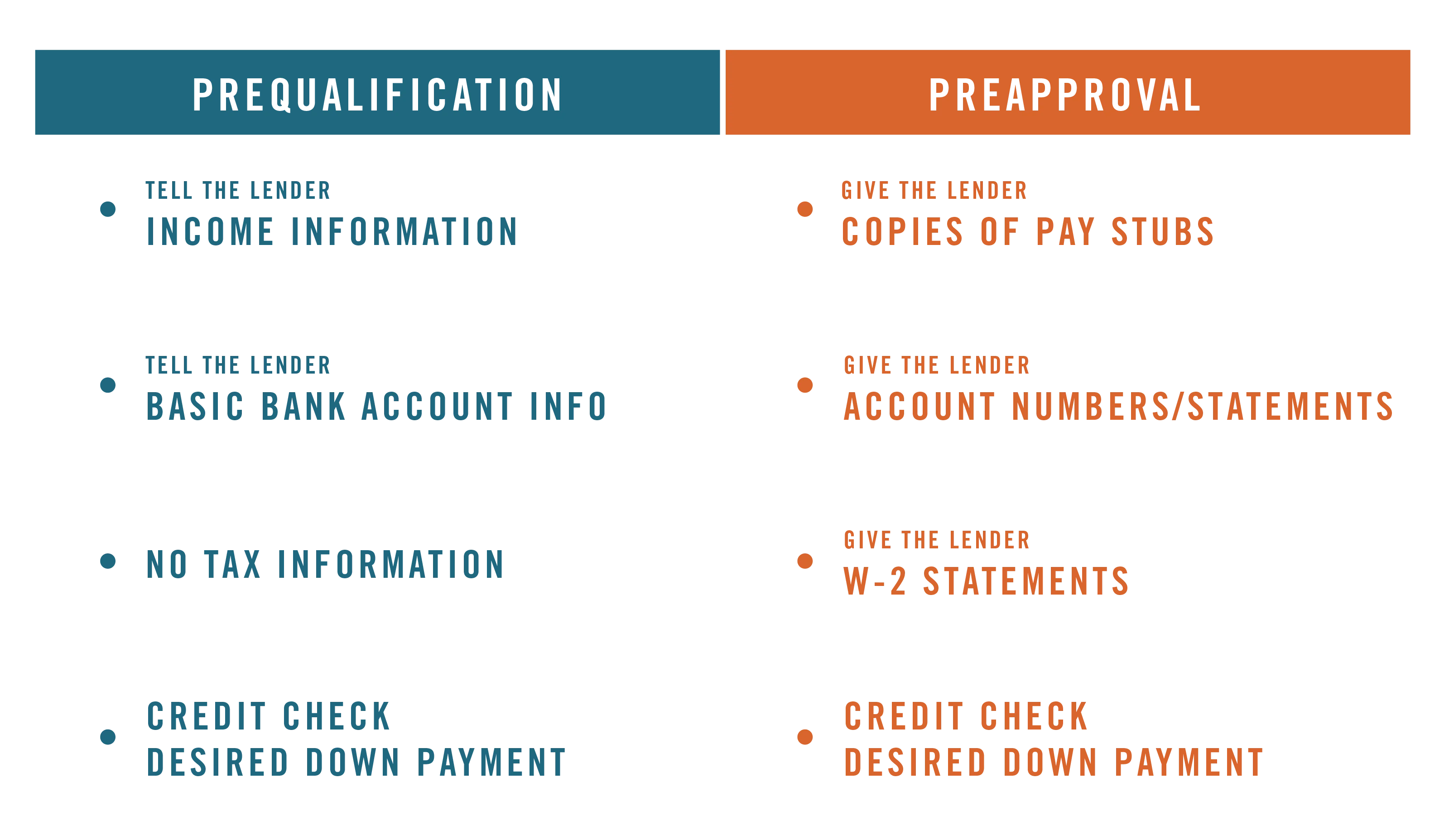

What’s the difference between prequalification and preapproval?

A prequalification is meant to give you direction when you go to buy a home, not necessarily guarantee that you’ll be approved. This is different from a pre-approval, which according to Bank of America is the closest you can get to an approval before the purchase contract is written for the home.

Getting prequalified takes less time and you don’t have to provide as many documents to the bank. For instance, instead of providing tax returns and proof of income like you would for a pre-approval, you can simply tell them the information they need. While the bank could still not approve you for the loan, it does give you more of an idea on whether or not you could get approved and what you can afford.

A pre-approval is different in that it requires more information to be given to the bank and takes a little longer to receive. You will have to fill out a mortgage application, and the lender will look over it and pull your credit report. If you are pre-approved, you will receive a preapproval letter informing you. While problems could still arise with the appraisal or your application causing the approval to fall through 2 , it is essentially an offer to lend you a certain amount with a specified rate. Mortgage preapprovals are normally good for 90 days.

Here’s a breakdown of the information you will need to provide for a prequalification vs. a pre-approval.

Benefits of being prequalified

Getting a prequalification is a simple process, and comes with some serious benefits. Here’s how prequalifying can help you buy a home.

-

Get a jump on the right house

When the market is flooded with buyers and they are all going after the same homes, you want to find ways to make sure you’ll get the right home. Prequalification is one of those ways. You can confidently make offers right away and sellers will take your offers more seriously knowing you’ve talked with a bank. -

Get a clearer picture of what you can afford

While you might have an idea of what you feel comfortable paying each month, a lender might have a different opinion. This is why prequalification is beneficial. It gives you direction from the bank on what price range you can realistically shop in 3 – saving you some disappointment down the road.

This will also give an idea of how much you’ll need to put down on the home and for closing costs. Having this knowledge beforehand can really change the direction you choose to go when looking for a home. -

Find out what’s available

Heading to the bank right away for a prequalification allows you to learn about the options available to you. Since the bank has your information, they can go over the different types of loans you could get. This will help you choose between a USDA loan, FHA loan, VA loan, conventional loan, or any other type of loan. They can help you understand their different requirements concerning down payments, funding fees, insurance premiums, and more.

If you are a first time home buyer, this can be really educational, and you might even be able to qualify for a no money down option. -

Save time

We know you’ve got a lot going on, especially if you’re considering moving. What you don’t need is to waste your time looking at houses you can’t afford and won’t get approved for. Getting a prequalification helps you look at houses you know you can afford and gives the lender a head start on your final approval when you go to purchase a home – saving you time.

If you are a first time home buyer, this can be really educational, and you might even be able to qualify for a no money down option. -

Resolve problems early

When going to get a prequalification, you could find out about some things that are in the way of your approval. This could happen as the bank looks into your information and does a credit check. Certain marks on your credit report or some of your outstanding debt could be keeping you from being approved or from being able to afford more. Finding out about these problems early allows you to deal with them and resolve them before starting the process of buying a home – leading to a smoother process later on.

What happens if I don’t get prequalified?

There are two main reasons someone may not be prequalified - either they’ve chosen not to do it, or they tried and aren’t able to.

If your problem is the latter, it’s best to ask your lender what problems need to be fixed so that you can get prequalified or preapproved for a loan. They should be able to help you identify any changes that need to be made to improve your chances.

If you are not getting prequalified simply out of choice, then there are some risks you need to be aware of if you don’t get prequalified before looking at houses.

-

Your financing could end up falling through

If you make an offer on a house without getting the go ahead from a lender, you are taking the risk of not qualifying down the road. This would lead to the contract for the home falling through. The seller would then move on to another buyer, and you would be left looking for another home and wondering what happened. While a prequalification still does not guarantee approval down the road, it does give you more clarity on whether or -not you would be. Knowing that your limits before making offers can save you some serious headaches down the road. -

You could get in over your head

Sometimes you can find information online that tells you what the expected mortgage payments on a home would be. This could lead you to make offers on a home that - pending approval- would actually cost you even more each month. Online estimates don’t always take into account your full financial situation, so it’s a bad idea to go house hunting based solely on that information. If you base your offers on what you see displayed online instead of information from a lender, you could end up making an offer on a home that will cost you more each month than you expected. -

You may not be allowed to see every home

Realtors will sometimes require a person to be at least prequalified to even see the home. This can happen when the market is really busy. Real estate agents don’t want to waste their time showing the house to people who don’t really intend on buying the house or couldn’t get approved. Having a prequalification letter shows that you are already working with a lender and are a serious buyer.

Disclosures & References:

1

“How to prequalify for a Mortgage”, chase.com, accessed 3/30/2022,

https://www.chase.com/personal/mortgage/education/buying-a-home/get-mortgage-prequalify

2

David Mully, “Prequalify for a mortgage - How to Prequalify for Mortgages”, mortgageloan.com, accessed 3/30/2022,

https://www.mortgageloan.com/prequalify-for-a-mortgage

3

Valencia Higuera, “How to Prequalify for a Home Loan as a First-Time Home Buyer”, themortgagereports.com, Mar 28, 2022,

https://themortgagereports.com/75893/how-to-pre-qualify-for-home-loan